Profit & Loss: Aptitude Questions & Answers – Free Practice!

Profit & Loss Notes & Video Lecture

Q. 1 A shopkeeper prides himself on offering the best deals. He purchases a batch of 40 pens for ₹50 and later sets a price where he sells 30 pens for ₹50. While doing this, he wonders: what is the percentage of profit he’s actually making on each pen?

Check Solution

Ans: B) 50%

Cost price (CP) of 1 pen = 50 / 40 = ₹1.25.

Selling price (SP) of 1 pen = 50 / 30 = ₹1.6667.

Profit % = [(SP – CP) / CP] × 100 = [(1.6667 – 1.25) / 1.25] × 100 = 33.33%.

Q. 2 Two friends, A and B, partner up to start a business. A invests ₹50,000, and B contributes ₹40,000. After a few months, B notices he’s entitled to a profit share of ₹6,000. Curious about how their business is doing, they ask their accountant: what is the total profit generated by their venture?

Check Solution

Ans: C) ₹13,500

The profit ratio of A and B = 50,000 : 40,000 = 5 : 4.

Let total profit be P. Then, B’s share = 4/(5+4) × P = 4/9 × P.

Given, 4/9 × P = 6,000.

P = 6,000 × 9 / 4 = ₹13,500.

Q. 3 A merchant known for his clever pricing strategy mixes two types of sugar: one costing ₹24 per kg and the other ₹30 per kg. He blends them in the ratio of 1:2 and sets a selling price that gives him a 20% profit. Can you determine the selling price of his mixture per kg?

Check Solution

Ans: D) ₹33.60/kg

Cost price of the mixture = (1 × 24 + 2 × 30) / 3 = (24 + 60) / 3 = ₹28/kg.

Selling price for 20% gain = 28 + 20% of 28 = ₹33.60/kg.

Q. 4 A neighbourhood shopkeeper purchases 20 kg of rice at ₹50 per kg and another 30 kg at ₹60 per kg. After mixing the two, he decides to sell the entire lot at ₹65 per kg. How much profit or loss percentage does he earn on this sale?

Check Solution

Ans: 16% profit

Total CP = (20 × 50) + (30 × 60) = 1000 + 1800 = ₹2800 for 50 kg.

SP = 50 × 65 = ₹3250.

Profit % = [(SP – CP) / CP] × 100 = [(3250 – 2800) / 2800] × 100 ≈ 16.07%.

Q. 5 Two entrepreneurs, A and B, pool their resources to start a venture. A invests ₹40,000, while B invests ₹50,000. They agree to split profits in proportion to their investments. If their business earns a total profit of ₹13,500 in the first year, how much of this profit does B take home?

Check Solution

Ans: ₹7,500

Investment ratio of A and B = 40,000 : 50,000 = 4 : 5.

B’s share = 5/(4+5) × 13,500 = 5/9 × 13,500 = ₹7,500.

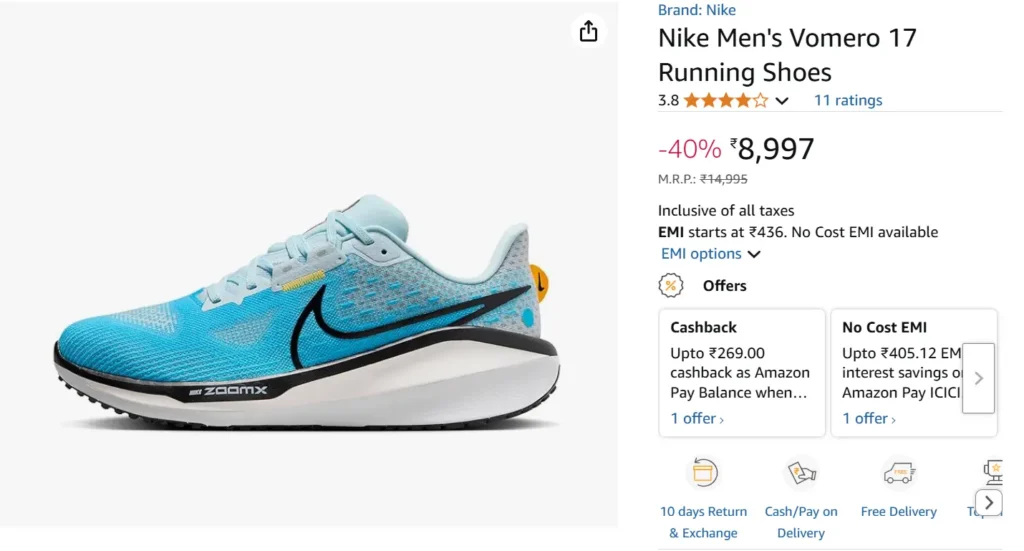

Q. 6 How much additional money you will save tentatively if you bought given shoe for 60% discount?

Check Solution

New Selling Price = 15000 * (1-0.6) = 6000

Original Selling Price = 9000

Additional Discount = 9000 – 6000 = 3000

Q. 7 Nandalal sells two identical Sarees for ₹990 each. However, he gains 10% on one Saree and incurs a 10% loss on the other. After totaling his transactions, he wonders if he’s made an overall profit or a loss—and by what percentage?

Check Solution

Ans: C) 1% loss

Let the CP of item 1 be ₹x, and for item 2, it is also ₹x.

SP of item 1 = x + 10% of x = 1.1x.

SP of item 2 = x – 10% of x = 0.9x.

Net loss = (10% of 10%) = 1%.

Q. 8 Abha buys a gift item, sells it to Benny with a 20% profit, and Benny then sells it to Chandu at a 10% loss. If Chandu pays ₹216 for the item, what was the original cost price that Abha paid for it?

Check Solution

Ans: B) ₹200

Let the CP for A be ₹x.

After A sells to B at 20% profit: SP for B = 1.2x.

After B sells to C at 10% loss: SP for C = 0.9 × 1.2x = 1.08x.

1.08x = 216, so x = 216 / 1.08 = ₹200.

Q. 9 Three partners—Adani, Birla, and Clark—invest ₹10,000, ₹15,000, and ₹20,000 respectively in a business. Adani also takes on the role of a working partner and earns 20% of the total profit for his efforts. If the business generates ₹25,000 in profit, how much of the remaining profit does Birla receive?

Check Solution

Ans: ₹6,000

A’s service share = 20% of 25,000 = ₹5,000. Remaining profit = 25,000 – 5,000 = ₹20,000.

Investment ratio = 10,000 : 15,000 : 20,000 = 2 : 3 : 4.

B’s share = 3/(2+3+4) × 20,000 = 3/9 × 20,000 = ₹6,000.

Practice Profit & Loss – Smarter Way!

Aptitude Tests | Bank Exams | SSC CGL | CAT Quant

Q. 10 Given Selling Price = 7620 and Loss = 1130, find out the Cost Price

Check Solution

Ans: A

Cost price (CP) = Selling Price (SP) + Loss

Q. 11 When someone makes a profit from selling a house, they need to pay taxes on the difference between the selling price and the original purchase price. If the profit is 20% or less of the purchase price, the tax rate is 6%. Any profit exceeding 20% of the purchase price is subject to a 10% tax rate. A business family bought a house for 164,000 dollars and sold it 15 years later for 228,000 dollars. How much tax must they pay on the profit?

Check Solution

Ans: B

the profit earned is 64000. Now 20% of this profit will be 12800

taking 6% of 12800 will be 768

Now beyond 20% of 12800 means 80% of 128000.

We will get 0.8 of 128000 as 51200. This amount 51200 is taxed at 10%

0.1 of 51200 = 5120

adding 1 and 2

768+ 5120 = 5888

Q. 12 A manufacturing company sold 400 units of a part at Rs 80 per unit and another 5000 units at Rs 50 per unit to a German automobile company. The cost to produce each unit was Rs 60. What was the company’s total profit or loss after selling all 900 units?

Check Solution

Ans: D

The company made a total of 400 x 80 = 32000 from the 400 units sold for 80 each.

The company made a total of 500 x 50 = 25000 from the 500 units sold for 50 each.

The total revenue from the 900 units sold is 32000 + 25000 = 57000.

The total cost of producing the 900 units is 900 x 60 = 54000.

The company made a profit of 57000 – 54000 = 3000 on the 900 units sold.

So the answer is 3000

Q. 13 Luke purchased two tickets for a Concert: one corner ticket costing 156 dollars and one mezzanine ticket priced at 184 dollars. He later sold the corner ticket for 25% more than its purchase price and the mezzanine ticket for 25% less than what he originally paid. Calculate Luke’s overall profit or loss from these transactions.

Check Solution

Ans: B

He sold the concompany ticket for 25 percent more than he paid for it, so he sold it for 156*1.25 = 195

He sold the mezzanine ticket for 25 percent less than he paid for it, so he sold it for 184*0.75 = 138

His total income from selling the tickets was 195+138 = 333

He paid 156+184 = 340 for the tickets, so he made a profit of 333-340 = -7

So the answer is -7

Q. 14 A clothing store owner purchased two equal-sized batches of dresses at identical costs. The owner sold every dress from the first batch for 70 each, making a profit of 1,600. The second batch was sold for 90 per dress, bringing in a profit of 2,400. How many dresses were there in total in both batches?

Check Solution

Ans: D

Lets say there were x number of dresses in each shipment. And cost of the each dress is y. Then we can set up following equation:

70x – xy = 1600

90x -xy = 2400

20x = 800

x= 40

Therefore there are 80 dresses in both shipments

Q. 15 A shopkeeper experiences a 20% loss on a defective mobile phone when compared to its selling price. If the phone originally cost 6000, what is the selling price?

Check Solution

Suppose selling price is x; Loss = 0.2x

Cost price = x+0.2x = 6000

=>1.2x = 6000

x = 5000

Q. 16 A shopkeeper sold 25%, 30% and 20% of the items at a profit of 10%, 20% and 30% respectively. Rest of the items are sold at cost price. What is the percentage of profit of all his sale? (TCS NQT Problem)

Check Solution

Suppose 100 items are bought at 1 rupee each.

Cost price = 100

Selling Price = 25*1.1 + 30*1.2 + 20*1.3 + 25 = 114.5

Profit Percentage = (114.5 – 100)/100

Profit Percentage = 14.5%

Smart Practice for Faster Results!

Placement Tests | Bank Exams | SSC CGL | CAT Quant

Want to challenge yourself? Try 10-minute Aptitude Test on Profit and Loss!

Refer Thousands of Quantitative Aptitude Questions with Answers and Detailed Solutions

Can you solve these interesting word problems from Profit and Loss?

1. Math Behind Reselling Exclusive Sneakers